UltraSmart Accreditation

Embark on a Realistic, Achievable Long Term Trading Career

UltraSmart Accreditation: Realistic, Achievable, Regulated

You build the plan, we provide the path for Long-Term Funding.

Introducing the first certification plan in the industry to offer unparalleled flexibility in customizing trading plans across a variety of instruments. Designed to enhance trader success, UltraSmart allows for dynamic features attuned to your trading personality with no defined timelines to your trading journey

Tailor your Trading. Use our Dynamic Plan Builder

The success of the UltraSmart Accreditation hinges on adaptability and choice. We recognize that every trader is unique, which is why we offer plans tailored to diverse trading styles. Our dynamic accreditation plan empowers you to take the reins, acknowledging that trading isn’t a one-size-fits-all endeavor.

Craft an environment that harmonizes with your strategies. Whether you lean towards aggressive maneuvers or prefer a more conservative approach, we provide the flexibility to align with your trading personality.

Our commitment is simple: you set the expectations, and we provide the capital. Your success is our priority, and we’re here to help you achieve your goals, every step of the way.

Features of the UltraSmart Accreditation

50+ FX, Metals,

Oils, Indices

build your Plan to

suit your strategy

Dynamic targets

& Drawdowns

Live Traders

use live funds

1:30

BASE LEVERAGE

NO

TIME-LIMITS

Upto 90%

PROFIT SHARE

Fast reliable payout

systems

UltraSmart Accreditation

Choose from four account sizes to get started

$25K

Account Size-

Single Phase Evaluation

-

No Time Limits

-

70-90% Profit Split

-

From 6% Profit targets

-

Max Stop out -8% Balanced Based

-

Daily Drawdown - -4%

-

Maximum Scaling - Up to $5,000,000

-

Custom-Fit options available

$50K

Account size-

Single Phase Evaluation

-

No Time Limits

-

70-90% Profit Split

-

From 6% Profit targets

-

Max Stop out -8% Balanced Based

-

Daily Drawdown - -4%

-

Maximum Scaling - Up to $5,000,000

-

Custom-Fit options available

$100K

Account Size-

Single Phase Evaluation

-

No Time Limits

-

70-90% Profit Split

-

From 6% Profit targets

-

Max Stop Out - -8% Balance based

-

Daily Drawdown - -4%

-

Maximum Scaling - Up to $5,000,000

-

Custom-Fit options available

$200k

Account Size-

Single Phase Evaluation

-

No Time Limits

-

70-90% Profit Split

-

From 6% Profit targets

-

Max Stop Out - -8% Balance based

-

Daily Drawdown - -4%

-

Maximum Scaling - Up to $5,000,000

-

Custom-Fit options available

Build your UltraSmart Plan, Pass your Goals, Reach your Full Potential

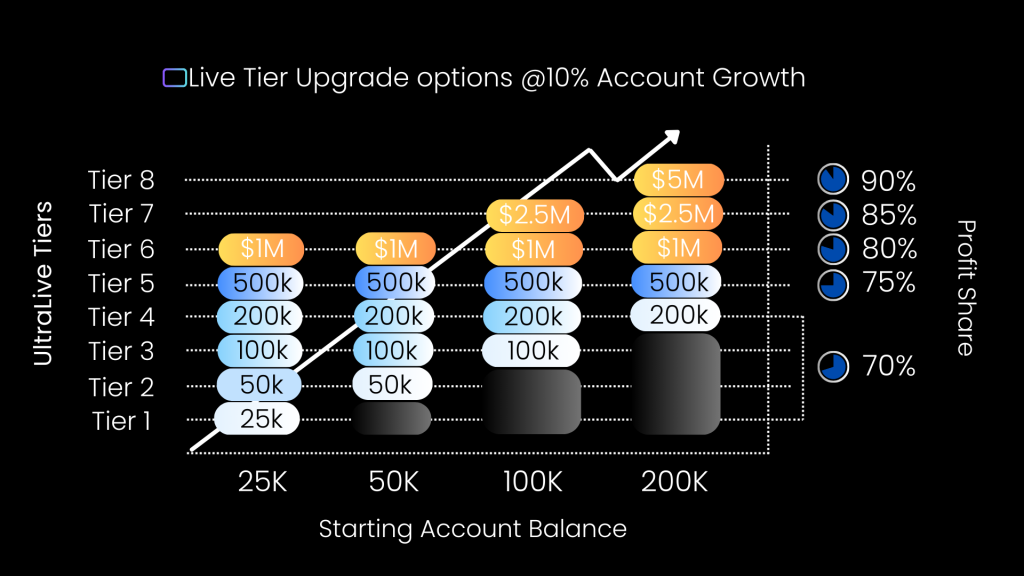

The UltraSmart Scaling Plan

Sustainable Prop Practice

In today’s fast-paced market, staying ahead of the curve is essential.

Our all-in-one trading plan streamlines the process, providing you with unparalleled convenience and efficiency. Say goodbye to complexity and hello to simplicity – with just one plan, you can access a world of opportunities.

UltraSmart was the first of it’s kind when it was released in 2021. And we are keeping it unique by putting you in control of building your trading plan, using our funding partners to back your trading approaches on real, regulated brokerages, and aligning our own business goals with the successful performance of our trader data. Not evaluation fees.

If you’re looking for a Firm that is built to sustain your career long term, then there is only one choice, UltraCap Trading.

Program Rules

UltraSmart Important Information

The UltraSmart Plan is designed for the Consistent/Proven Retail Trader who understands that every trading strategy is unique. It offers a revolutionary approach, empowering traders to build and customize their plans to suit their specific trading styles and goals.

A First for the Industry: UltraSmart allows you to create the most achievable prop program tailored to your needs. This streamlined, single-stage process eliminates the complexity of multi-level challenges and gives you the flexibility to adjust key parameters to align with your success.

Build Your Path to Success:

- Customizable Plans: Use our innovative Plan Builder to tailor your trading plan. Adjust profit targets, drawdowns, and rules to fit your strategy. Whether you prefer a fast-track to professional trading or a longer-term career-focused journey, UltraSmart adapts to you.

- Achievable Goals: Start with just a 6% profit target and an 8% maximum stop-out. Modify these to suit your risk tolerance and trading style.

- Dynamic and Up-to-Date: Our Plan Builder evolves with the latest industry trends and funding patterns, ensuring your plan remains relevant and competitive.

- Single Stage, No Time Limits: Focus exclusively on trading without the pressure of deadlines. UltraSmart offers one of the best scaling plans in the industry, allowing you to grow at your own pace.

- Real Live Funds: Benefit from backing by our funding partners on regulated broker platforms. Your trading success is supported by real, live funds, providing a secure and professional environment.

- Professional Employment Conditions: Aim to become a professional trader under Australian Employment Conditions, with a clear and straightforward path to success.

UltraSmart is ideal for traders seeking a customizable, dynamic, and achievable path to becoming a funded professional trader.

The UltraSmart Scaling Plan is designed to reward consistent profitability and performance while maintaining a sustainable long-term business relationship. Here’s how it works

Live Funded Account:

Once accredited, traders receive a live funded account through a regulated broker, backed by our funding partners

- With our new advanced platform and funding partners, there is no probation period. You are fully funded from day one of live trading.

- Payout requests can be made at any time and processed at any time of the month, thanks to our automated system that ensures quicker payouts compared to previous methods.

- To request a payout, it must be done in 10% blocks to ensure the maturity and sustainability of our investment in your trading.

- For Every 10% Profit Earned: rather than request a payout fee, you can use the fee to upgrade to the next Live Tier which increases your account size and trading capital.

- Always sustainable: It was just 4 years ago before the advent of unregulated “B Book only” Online Funding Companies led by influencers disguised themselves as Prop Firms. For the 35 years before this, true proprietary trading organizations offered realistic, sustainable models that ensure long term viability for both trader, investor and/or proprietary fund. We have maintained this model since day one, a testament to the validity and long term sustainability of our funding models.

- No Probation: You are fully funded from day one, eliminating any probation period.

- Automated Payouts: Faster and more efficient payout processing.

- Sustainable Investment: Ensures a long-term and reliable business arrangement benefiting traders, funding partners, and our recruitment firm.=

How is this plan different from other firms’ plans?

Unlike other firms that might not use real funds, or operate profit withdrawal systems as an unregulated broker, our plan ensures the maturity of our partner’s investment in you through minimum profit requirements. This approach creates a sustainable long-term business relationship that is beneficial for traders, investors, and the firm alike.

At UltraCap Trading, we aim to create a trading environment that is both transparent and conducive to long-term success. We welcome a variety of trading strategies but have set certain guidelines to ensure fair play and responsible trading. These guidelines are designed to protect both our traders and funding partners and outline what we are looking for in a long term trading partner.

Trading Strategies and Approaches

• Single Defined Trading Approach: We encourage traders to use a single, defined trading approach for each account. If you wish to employ multiple trading strategies, please use separate accounts. This ensures that your trading results are distinguishable and consistent which makes it easier to qualify for multiple funding options and pools of capital.

• Expert Advisors (EAs): EAs are permitted but must adhere to our responsible trading guidelines. For instance, EAs employing high-risk strategies like Martingale are not allowed.

• News Events, Rollover, and Holding Trades: Trades can be held overnight, over the weekend, and during news events, unless otherwise specified.

Traders are reminded that UltraSmart uses Live Feed Data Accounts. This means that whilst the environment is a regulated demo server, your fills, spreads, rollover spikes, slippage and liquidity trading data is mirrored from live servers to simulate as close to real world trading conditions. Should you choose to hold open positions during high volatility periods or through low liquidity during rollovers on various markets, please factor this in to your risk management and trading practices.

Risk Management Requirements.

• Limited Trade Stacking: On the base UltraSmart Plan, you may have up to 2 open trades per symbol, provided they are opened simultaneously and at the same price level. Further customization of the base plan will allow you to increase the number of open positions you can have per symbol.

• No High Risk/Gambling Trading Strategies: Strategies that involve scaling into a position or excessively stacking trades are not permitted – (This includes Grid, Martingale & Hedge Strategies along with any strategy closely resembling tactical gambling theories – at our risk team’s discretion)

• Dummy Trading: Placing insignificant trades just to meet the required number of trading days is not allowed.

• No Trade Copying Between Accreditation Accounts: Trades should not overlap between accreditation accounts to maintain the integrity of each unique strategy.

• No High Frequency Trading or Arbitrage: Strategies that rely on High Frequency Algorithms or Arbitrage to front run the market, are not allowed.

Note: Our Risk, or Funding Team and Trading Partners reserve the right not to fund any strategy that they deem to have inconclusive results, lack consistent performance, or pose unreasonable risk. It is your responsibility to adhere to the above guidelines. There will be no refunds or retries for willful or reckless breaches of the above requirements.

The Master Services Agreement which covers the full funding requirements can be found in our compliance section, in the plan purchase checkout and here: Click here

6%-10% Growth is all that is required to meet the minimum profit for submitting your results and onboarded as a Live Portfolio Manager.

(Starting Account Balance) + (Starting Account Balance * 6%-10%)

Drawdown is a natural part of trading, and every good trader must not only demonstrate how they win but also show they can handle drawdown effectively. UltraSmart is designed for experienced, disciplined, and controlled traders, offering the ability to trade across a wide range of additional correlated markets.

To help us observe this, the following stop out (max drawdown) requirements are enforced:

Customized Stop Out Limits:

6%-8% Stop Out Limit:

- Your account equity must not reach an amount that is 6%-8% less than your starting account balance (absolute drawdown triggered on equity)

- The specific limit depends on how you customize your plan using the Plan Builder.

Example for Some Plans:

- If your account balance is $100,000, your account will be disabled once equity reaches $92,000:

- $100,000 – (8% * $100,000) = $92,000.

- If your open equity falls to 6%-8% below your starting account balance, you will need to reset and start again with a new trading plan via your Client Portal Dashboard at a generously discounted price.

4% Daily Loss Limit:

- Our Daily Drawdown Rule is one of the simplest and most generous in our industry.

- You must not draw down more than 4% of your Daily Account Balance in a single trading day.

Example:

- If your account balance at the start of a new trading day (server time) is $100,000, your Daily Loss Limit is set to $4,000.

- If your Account Equity at the start of the new trading day is $99,000 and your Daily Loss Limit is $4,000 (Your closed account balance being $100,000), and your equity reaches $96,000 at any time during the same trading day, your account will be disabled, and you will need to start again with a new trading plan via your Client Portal Dashboard at a generously discounted price.

We do not use unrealistic rules like “Relative Drawdown” or “Trailing Stop Out,” as we believe these are designed to fail traders. Instead, UltraSmart provides clear, achievable, and fair drawdown limits tailored to your customized plan.

To ensure responsible trading and minimize risk, we encourage best practice to have an active Stop Loss on all orders. Whether you require a Stop Loss will be outlined on your Plan Builder Summary at the time you build your plan.

Stop Loss Requirements Tailored to Your Trading Style:

With UltraSmart, you have the flexibility to customize Stop Loss requirements based on your unique trading strategy. Build your plan to suit your needs, ensuring your approach aligns with your risk management preferences.

While some UltraSmart plans may not mandate an active Stop Loss, we strongly recommend using one to safeguard your trades.

Best Practices:

- Use Execution Software: We recommend utilizing execution software to ensure Stop Losses are applied to all orders, including limit orders.

UltraSmart empowers you to create a trading plan that fits your strategy while promoting responsible risk management practices.

Maximum Time to achieve Profit Target: None

- There is no time limit to pass the accreditation program requirements, and then submit their trading results for a Quick Strategy Check and Funding Outcome.

- UltraSmart traders need to be careful to not go “inactive” during their accreditation. Brokers are known to disable accounts that have been inactive (not seen any activity for more than 28 days). Opening new positions is classed as “activity”. Simply logging into your account, or monitoring open positions, is not classed as “activity”.

Minimum Trading Days:

UltraSmart requires that a trader submit for live funding once they have at least traded for 15-30 active trading days. If you hit your profit target before executing the minimum prescribed active days worth of trades assigned to your Custom Plan, you will be required to continue trading until you have achieved the minimum trading day worth of trading history for us to check.

- An active trading day is defined as: “Any day where a new trading position is opened counts as a single active trading day.”

- Positions that roll over multiple days only count as a single active trading day.

Our mandate is to recruit quality traders that display consistent long term risk management and execution skills, with a high likelihood of remaining funded after we allocate capital to them. To achieve this, we require a minimum size of trading history to be able to verify a trader’s probability to remain funded for the long term. Although we appreciate this may not be a popular rule, any consistent, successful trader is not afraid of losing any profits if they trade for a slightly longer period of time before gaining long term funding.

All (50+) FX Pairs as available:

UltraSmart Accreditation is undertaken on our Broker Partners’ Regulated Platform Simulation Account

Accounts are not instant execution like most broker demos. They are simulating live trading conditions, so fills, commissions, spreads, slippage and all other trading conditions are factored into the platform to ensure that we get as close to real world trading conditions to observe traders performance.

Once Trader has proven their skillset and edge and signed to become a Live Trader, they will be moved to Live, Regulated A/B/C Book Managed Accounts.

It is important to note that symbols are subject to change by the Liquidity Provider without notice, and may also vary between platforms.

All FX, Commodities, Metals, Energies, and Indices available + Crypto (list changes regularly):

FX Majors, Minors, Exotics (55+ pairs) |

|||||

| AUDNZD.b | EURCAD.b | GBPJPY.b | USDJPY.b | USDZAR.b | ZARJPY.b |

| AUDCHF.b | EURCHF.b | GBPUSD.b | EURHUF.b | AUDSGD.b | MXNJPY.b |

| AUDJPY.b | EURGBP.b | GBPNZD.b | USDSGD.b | SGDJPY.b | NOKJPY.b |

| AUDUSD.b | EURJPY.b | NZDCAD.b | EURPLN.b | USDHKD.b | CNHJPY.b |

| CADCHF.b | EURNZD.b | NZDCHF.b | EURTRY.b | USDPLN.b | USDBRL.b |

| AUDCAD.b | EURUSD.b | NZDJPY.b | USDDKK.b | USDSEK.b | EURSGD.b |

| CADJPY.b | GBPAUD.b | NZDUSD.b | USDHUF.b | USDTHB.b | GBPSGD.b |

| CHFJPY.b | GBPCAD.b | USDCAD.b | USDMXN.b | USDTRY.b | NZDSGD.b |

| EURAUD.b | GBPCHF.b | USDCHF.b | USDNOK.b | EURNOK.b | EURHKD.b |

| USDCNH.b | |||||

Metals, Energies |

|||||

| XAUUSD.b | USOIL.b | ||||

| XAGUSD.b | UKOIL.b | ||||

Crypto pairs |

|||||

| BCHUSD.b | BTCUSD.b | ETHUSD.b | LTCUSD.b | ||

Indices |

|||||

| AUS200.b | SPX500.b | VIX.b | |||

| US30.b | EUSTX50.b | US2000.b | |||

| FRA40.b | GER40.b | USDX.b | |||

| GER30.b | HK50.b | SWI20.b | |||

| UK100.b | CAN60.b | NTH25.b | |||

| NDX100.b | |||||

| JPN225.b | |||||

At UltraCap Trading, we offer the flexibility to trade multiple trading plans simultaneously, providing you with the opportunity to diversify your portfolio across various leverage points, capital amounts, and markets.

-

Multiple Accounts: Traders can operate up to three accreditation accounts at the same time, each showcasing a unique Single Defined Trading Approach. This allows a trader to diversify their overall portfolio with different types of strategies, whilst being able to safely stack leverage, capital and risk to boost earning potential.

-

No Un-Authorized Trade Copying: Copying Trades, whether partially or fully, from another account within the UltraCap without permission is considered a serious violation of our Terms and Conditions. The purpose of multi account is to diversify your approaches, and any account displaying intent and/or evidence of trade copying from any other account on our trading network (including Eightcap), is a breach of our terms and conditions.

-

Single Defined Trading Approach: The main contributors to a strategy’s footprint are lot sizing, timing, symbol choice, and trade management. Similar trades between accounts can impact the outcome of your funding eligibility and may even lead to disqualification without refund.

Starting leverage is now dynamically set for UltraSmart Plans. This is starting at 1:30 for FX, 1:10 for Metals/Oil, 1:5 for Indices/Stocks & 1:2 for Crypto

Leverage and Margin requirements may change Dynamically to protect capital through periods of extreme volatility or major market shifts.

Join our mailing list!

SIGN UP TO RECEIVE EMAIL UPDATES ON NEW PRODUCT ANNOUNCEMENTS, PROP INDUSTRY UPDATES, PROMOTIONS, INSIDER INFORMATION AND MORE!

TRADERS ACHIEVING FINANCIAL FREEDOM

Don't take our word for it, read what other traders say!

UPDATE: The portal is back up and I’m an idiot, but UltraCap still rocks!!!

As used by other Traders!

JOIN THE ULTRACAP TRADING COMMUNITY

A vibrant hub for trader development, idea sharing, and support. More than just a platform, this evolving academy is crafted to foster and showcase emerging trading talent.

Connect with like-minded traders on our UltraCap Discord. Enjoy exclusive access to giveaways, competitions, discounts, and more in our #promotions channel