FRquently ask Question

Ask us anything

Looking for something? Use the Search box below to find the answers!

1. About UltraCap Trading

- Who are we? What is UltraCap Trading?

UltraCap Trading is an authentic Trader Recruitment Firm owned and operated in Australia. Passionate about recruiting, profiling, and managing top-tier retail trading talent, we’re a one stop shop for each stage of your growth.

Here’s how we do it:

For Traders:

We offer a technology-driven platform where traders can showcase their skills in a real-world simulated environment. Those who meet our criteria are offered contracts to trade on live funded accounts. These accounts feed into our overall live funding pool, becoming part of a unique ecosystem managed at a macro level.For Funding Partners:

We provide a secure and transparent portal where our funding partners can access high-quality, anonymized trading data. This data is generated by our contracted traders and processed through our proprietary AI Risk Management Platform. This enables our partners to use their private equity to generate their own returns in a unique and secure manner.Streamlined Process:

We eliminate the complexities often associated with the trader-investor relationship. Our technology handles the heavy lifting, allowing traders to focus on trading and our private equity partners to concentrate on risk management and technology, rather than HR and compliance issues.By serving as this essential bridge, UltraCap Trading creates a mutually beneficial ecosystem for both aspiring traders and private equity ventures. We maintain the highest standards of transparency and ethical conduct throughout this process.

Distinct Approach:

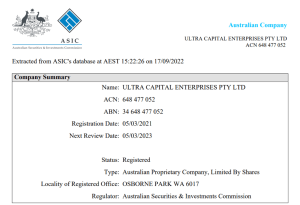

Unlike traditional proprietary desks and online trading firms, UltraCap Trading focuses exclusively on the meticulous management and organization of trading talent. We execute pooled strategies into consumable, risk-managed outputs that our partnered institutional and high-net-worth parties can leverage. We offer a streamlined platform that fosters a synergistic relationship between traders and investors. Traders are provided with bona fide career contracts, governed by stringent financial regulations. Meanwhile, our private equity subscribing partners gain access to a platform designed to effortlessly harness the potential of retail trading talent. This approach eliminates the need for complex risk management, resource allocation, and the legal intricacies often associated with such ventures, thereby reducing operational costs and complexities.Australian Company Registration:

International Legal Entity Identifier Registration:

- Why is Transparency in Liquidity Providers (LP) Important for Trust and Trading Conditions?

Understanding the role of liquidity providers in the accounts you are trading is vital for several reasons, including trading conditions and trustworthiness. Well-regulated brokers often have multiple liquidity providers, offering excellent trading conditions like tighter spreads and faster execution.

The Need for Transparency:

Transparency is crucial in the trading world. When a firm can aggregate liquidity themselves, they are essentially operating in a manner that should be financially regulated. This capability raises the potential for conflicts of interest and questions about the firm’s transparency and trustworthiness. It gives them the power to potentially modify or manipulate trading conditions, such as spreads, slippage, and fill efficiency.UltraCap Trading’s Commitment to Transparency:

At UltraCap Trading, we address these concerns by partnering exclusively with financially regulated global retail brokers. This partnership ensures key benefits for our traders:- No Conflict of Interest: We cannot manipulate or modify your trading conditions, ensuring that UltraCap is always aligned with the trader’s performance.

- Regulated Trading Conditions: Trading under conditions regulated and monitored by financial authorities adds an extra layer of security and trust.

- Third-Party Counter-Party: An external third-party counter-party is always involved in the trades we make through our master trading portfolio, ensuring that the funding is live, real, and regulated.

UltraCap Trading’s Approach:

We only operate our recruitment and live services with authentic globally known and trusted brokers. This ensures that the best real trading conditions are delivered to not only all their retail clients but also including our traders. This eliminates the potential for conflict of interest, as we do not have the ability to manipulate or modify the conditions of your trades. We do not have access to the price feeds, the slippage, or the spreads.By taking these steps, we aim to provide a transparent, trustworthy, and sustainable trading environment. We believe that transparency is the cornerstone of a long-term, successful trading career for our traders and a fruitful partnership with our funding partners. Our commitment to transparency, trust, and excellent trading conditions is unwavering, and that’s why we stand by our commitment to use only known and trusted, regulated global retail brokers.

- Is UltraCap regulated?

While UltraCap Trading doesn’t operate under a financial services license—since we’re a trading recruitment service and not a provider of financial, investment, or banking products—we adhere rigorously to regulatory standards. We operate in strict compliance with the Australian Securities and Investments Commission (ASIC) and under Australian Consumer Law.

Our Live Portfolio Managers (LPMs):

Our LPMs are contracted professionals who manage live-funded accounts on our behalf. They are not consumers who are buying and selling assets or investments. These allocations are administered through bridge and hub technology that complies with ISO27001, an internationally recognized standard for information security management systems.Our Technology Partnerships:

We exclusively collaborate with regulated brokers, liquidity and margin providers.Indirect Regulation:

By aligning ourselves with regulated entities and adhering to international security standards, we offer a form of indirect regulation. This ensures that our services to funding partners are both safe and secure, while also providing transparent and stable liquidity to our contracted LPMs.Our Compliance Credentials:

- ISO27001 Certification for Information Security via our margin account: Ensures that we adhere to international standards for information security management.

- Australian Consumer Law (ACL): Provides consumer guarantees and protections, ensuring that we operate in a manner that is fair to consumers.

- Consumer Protection and Fair-Trading Laws: Governed by the Australian Competition and Consumer Commission, these laws ensure that we operate transparently and fairly.

- LEI Certification: The Legal Entity Identifier (LEI) is a global identifier that provides transparency in financial transactions, ensuring that we are easily identifiable in the global marketplace.

- Australian Company Director Obligations: We adhere to the responsibilities and obligations outlined in the Corporations Act 2001, ensuring ethical and lawful management of the company.

- ASIC Registration/Compliance: While we are not a financial service provider and therefore do not hold an Australian Financial Services License (AFSL), we are still governed by the Australian Securities and Investments Commission (ASIC). This ensures that we operate in compliance with corporate laws, adhere to ethical business practices, and maintain transparency in our operations.

By maintaining these compliance credentials, we aim to provide a secure, transparent, and trustworthy environment for all our traders and funding partners.

- What is UltraCap's History in Funding Traders?

UltraCap Trading has been a transformative force in the trading industry since its inception. Founded and operated by traders who deeply understand the nuances of the market, we bridge the gaps between talent, credibility, and executional technology solutions for investors. Our team has specialized expertise in the FX and CFDs industry dating back to 2019. During this time, we laid the groundwork for a service that is fundamentally different—centered on creating win-win relationships between traders and investors.

In 2021, we formalized our innovative business model and introduced it to our original stakeholders. We also soft-launched within 12 private online trading communities, where we began to shape the futures of everyday retail traders aspiring to become full-time career traders. This initial success allowed us to refine our approach and services, setting us apart in an industry often focused more on trader failure than success.

Today, we stand as a beacon of excellence and innovation, complying under ASIC jurisdiction, a critical proof that is only stamped in a select few firms worldwide. While we may appear to align with the burgeoning online prop firm industry (trader b book funding firms), our focus is distinctly different. We are committed to the long-term success of our traders, offering them a platform that not only provides seed capital but also fosters sustainable growth and development. Our unique approach to trader recruitment and management has made us a preferred choice for both individual traders and institutional investors, solidifying our reputation as a leader in the field.

2. Getting Started

- How do I start with UltraCap Trading?

Starting with UltraCap Trading is not just easy, it’s also incredibly exciting! The process is streamlined into three straightforward steps to get you trading as quickly as possible. First, choose the best aligned trading plan for your lifestyle, experience and career goals. Select the plan and add any tailored mods or upgrades. Take your time to choose the one that aligns perfectly with your trading strategy and career aspirations.

Next, complete your commitment fee to secure your spot in the program. This is your ticket to showcasing your trading talent to us and our network of investors. Once the fee is processed, you’re all set to begin trading!

Finally, after you’ve met our modest trading requirements, your trading performance is presented to our esteemed panel of investors and our funding partner board. We then come back to you with both general and tailored starting capital options, giving you the flexibility to kickstart your trading career in a way that suits you best and that is tailored to give you maximum chances of success.

- What are the requirements to join UltraCap Trading?

To join UltraCap Trading, we have a set of basic yet important requirements to ensure a smooth and successful trading journey for you. First and foremost, you must be at least 18 years old and possess a valid ID for verification. A stable internet connection and a computer that can run standard broker software is advantageous, but using mobile and tablet apps is also permitted with caution.

While we welcome traders from all experience levels, it’s highly beneficial if you have some experience in demo trading or have traded with a broker before. This will not only help you navigate our platform more easily but also give you a head start in showcasing your trading skills.

Lastly, it’s crucial that you reside in a country that is not under any sanctions and is permitted to trade or transact with Australia. This ensures that we can offer you our full range of services without any legal complications.

Above all, we’re looking for individuals who have a genuine passion for trading and are committed to continuous learning and growth and a commitment to excellence.

- What is required to become a funding partner of UltraCap Trading?

Partnering as a Subscriber to our Risk Management Technologies is currently by invite only. The current version of our platform is in a closed stage 1 beta with a limited select number of first level members forming our funding partner board.

We will announce when stage 2 beta commences for additional partners to join. Stage 3 and 4 intakes will be dependent on feedback before an open beta is released to the public.

- How long does it take to become a trader with UltraCap Trading?

In our few years of operation, the average time it takes a trader to achieve funding is 4 months. Some have become funded in as little as 3-4 weeks; others have taken 4 attempts and 1-1.5 years. The average time it takes a trader to find consistency after passing is close to 6.5 months and the average number of attempts a trader makes before passing an accreditation trading plan is currently 2.8.

- What is the process of setting up my account with UltraCap Trading?

Setting up your account with UltraCap Trading is a straightforward, three-step process designed to get you trading as quickly as possible while ensuring you’re the right fit for our unique ecosystem.

Choose Your Trading Plan:

First, explore the various trading plans we offer. Each plan is designed to align with different trading strategies and career goals. Choose the one that best suits your needs.Sign Up and Pay:

Once you’ve selected your trading plan, you’ll be prompted to provide a few details and pay your Commitment Fee. This fee serves to provide you with a Trading Plan and Opportunity to showcase your talent on a simulated real world environment (spreads and commissions and fills matter) in your trading career with UltraCap and also covers the operational costs of running the accreditation program.Showcase Your Edge:

After your account is set up, you’ll start trading in a real-world simulated environment to showcase your skills and consistent edge. If you meet our modest requirements, your trading performance will be presented to our panel of funding partner managers and risk managers. We’ll then offer you general and tailored letter of offer which will include your onboarding options to provide your trading talent and services as a contracted employee of UltraCap! Unlike other companies in this space, UltraCap tailors funding options for our contractors. Although the amount of live funding you start with is always the same amount as the trading plan you accredit on, the options, addons and structures available give our traders the flexibility to choose a working model that can help them grow faster!By following these steps, you’re not just opening an account; you’re starting a potentially long-term, rewarding trading career.

- What countries/nationalities of traders does UltraCap Trading accept?

UltraCap Trading is an inclusive platform that aims to accommodate traders from around the globe. However, there are some limitations due to legal and regulatory constraints. Specifically, traders must belong to a country that is not under sanctions and is permitted to trade/transact with Australia.

Countries involved in geopolitical instability are restricted from trading with us currently include countries such as Russia (including the Crimea, Donetsk, Luhansk regions of Ukraine), Iran, North Korea, Cuba, Somalia, Syria.

USA and any other country that is not listed above is welcome to join our trading community and take the first steps toward a rewarding trading career with UltraCap Trading. We’re excited to offer a global platform where traders from diverse backgrounds can showcase their skills and realize the opportunity to become a professional trader.

3. Accreditation Program

- Account Inactivity

Inactivity Rule

Accounts that have no activity on them (specifically, no trades have been opened) for longer than 30 days will be disqualified. If an account is deleted or purged by the platform due to inactivity, it will be considered forfeited. You will need to repurchase and re-attempt the accreditation to continue so be sure to let us know right away!

- What is the Accreditation Program and How Does It Work?

The Accreditation Program is your pathway to becoming a professional trader with UltraCap Trading. It’s the process designed to evaluate your trading skills, risk management, and the consistency of your trading strategy. The program starts with choosing a trading plan, followed by a trading phase where you showcase your skills and edge, and concludes with a Quick Strategy Check. Successful completion leads to the onboarding phase, where you become a part of our unique trading ecosystem.

- What Does the Quick Strategy Check Entail?

The Quick Strategy Check is a quick check to ensure you’ve followed all guidelines and rules when trading to achieve the profit target.

Unlike during the trading phase where your trading behaviour is monitored (like risk amounts and using stop loss etc, trading days etc), the Quick Strategy Check is a quick check over the results you submit after you finish trading. We look at the strategy type and how it was executed and it is profiled for matching, so that we can present it for funding approval, and present you with live funding offers.

Think of it as the final due dilligence check to make sure all requirements are met and we are a good fit for eachother.

- How Does UltraCap Define Consistency in Trading?

In the prop trading industry, the term “consistency” can be interpreted in various ways, often leading to misunderstandings. Many other firms have “consistency” checks which do not follow a method and have been used to “fail” traders for no understood reason or if their equity curve was not smooth enough. You can be assured, we do not do this here.

At UltraCap Trading, we define consistency from the start with a specific definition that aligns with our goals and the expectations of our risk management teams and overall, expectations from our funding partners.

We define consistency as “Logical, Reliable Trading Behaviour observed in the results submitted when achieving the profit target.”

- Clear Pattern of Risk, Execution, and Trade Management: Consistency doesn’t mean you need a perfect equity curve. What it does mean is that your trading should display a clear and logical pattern in how you manage risk, execute trades, and manage those trades to fruition.

- Purpose and Plan: Your trading should reflect a well-thought-out strategy. Random trades, even if profitable, are not considered consistent because they don’t provide a reliable pattern that can be scaled or trusted over the long term.

- What Happens After Completing the Accreditation Program?

After successfully completing the Accreditation Program, you’ll enter the onboarding phase. This includes identity verification through KYC procedures and contract signing. You’ll then be offered a funded trading account, becoming a part of UltraCap Trading’s unique ecosystem.

- How Does UltraCap's Accreditation Program Stand Out?

Our program is distinct in its focus on not just profits, but also the consistency and edge of your trading strategy. We use a technology-driven approach to match your trading style with specific risk profiles and liquidity pools, ensuring a mutually beneficial relationship for both our traders and funding partners.

4. Trading Tools and Platforms

- What Trading Platforms Are Available?

At UltraCap Trading, we aim to provide a seamless and efficient trading experience. To achieve this, we ONLY provide regulated broker and liquidity provider options. This is still the only way that a proprietary trading company can ensure they do not have a conflict of interest with the trader and does not have access to manipulate the trading conditions against traders. Using award-winning and regulated publicly available brokers also ensures that multiple institutional-level liquidity providers are used, and the liquidity pool is larger than just the individual firm but expands to all the broker's clients and feeds. Always trade on regulated third-party broker platforms when attempting any proprietary trading challenges or programs to ensure your career is safe.

For more information on the specific platforms we are currently providing accreditation programs on, along with the markets, types of devices that are supported, disclosures, and credibility please visit the links below:

- Can I Use Third-Party Tools and Software?

Absolutely! We recognize that traders often have their own preferred set of tools, indicators, and Expert Advisors (EAs) that they find effective. You’re welcome to integrate these third-party tools into your trading strategy on non-web based platforms. However, we strongly recommend ensuring that any third-party tools you use are in compliance with our trading rules and guidelines to maintain the integrity of your trading activities.

- Is Mobile Trading an Option?

Yes, mobile trading is available through our broker-provided platforms, which are compatible with both Android and iOS. While mobile trading offers the convenience of executing trades wherever you are, we advise extra caution. Manual trading on mobile platforms can be prone to errors, so it’s crucial to double-check your inputs and settings.

Unfortunately mobile trading is not currently available with the DX Trade platform, which is currently only accessed via web browser. This may become available in the future.

- What Are the Technical Requirements?

To ensure a smooth trading experience, it’s essential to have a stable internet connection and a computer that meets the minimum system requirements for running the most common platform software plus any additional software you require to execute your strategy. Detailed technical specifications can be found in our client portal and our team is available to assist make your accreditation as smooth and successful as possible!

- How Do We Ensure Platform Security and Stability?

Security and stability are paramount at UltraCap Trading. Our brokers are carefully vetted to ensure they adhere to the highest standards of cybersecurity. Additionally, our platforms undergo regular maintenance and updates to ensure optimal performance and security. This ensures that you can focus on trading without worrying about the technical aspects of platform stability.

By offering a range of trading platforms and tools, while also ensuring their security and stability, we aim to provide an environment where traders can focus solely on their trading strategies, confident in the robustness of the technology supporting them.

- Do You Offer Any Proprietary Trading Tools or Indicators?

At UltraCap Trading, our primary focus is on offering a robust and flexible platform that empowers traders to showcase their skills using their preferred tools and strategies. While we currently do not provide proprietary trading tools or indicators, our platform is designed to be highly compatible with a wide range of third-party tools, giving you the freedom to customize your trading experience.

In addition to this, we understand the importance of cutting-edge technology in modern trading. That’s why we also engage in exclusive partnerships with other leading trading technology companies. Through these partnerships, we bring a curated selection of advanced trading tools and resources directly to our trader clients and employees via our client portal. This approach allows us to offer you the best of both worlds: the freedom to use your preferred tools and the opportunity to explore new, innovative solutions that can enhance your trading performance.

- Is There a Demo Account to Practice On?

While UltraCap Trading itself does not offer demo accounts, we highly recommend utilizing the demo services provided by brokers that we use if you wish to try platforms out before embarking on one of our accreditations.

You can download the platforms and try them here:

5. Fees and Payments

- What are the fees associated with UltraCap Trading?

At UltraCap Trading, we charge a one-time commitment fee for the Accreditation Program. This fee covers the operational costs and ensures that we can provide a high-quality trading environment. Additionally, live traders are subject to standard trading costs such as spreads and commissions, but these are not passed on to you and are absorbed by our macro pool and funding partner services.

- How do I pay for the Accreditation Program at UltraCap Trading?

At UltraCap Trading, we offer multiple payment methods to make the payment process as convenient as possible for you. All payments are processed securely through our encrypted payment gateway, ensuring the utmost security and confidentiality of your financial information. Here are the options:

- Visa/Mastercard - The fastest most secure way to pay for accreditation and anything online. Use of a Credit Card not only protects you, but ensures a quick and smooth account onboarding process.

- Crypto Transfer: For those who are comfortable with cryptocurrencies. This method offers the advantage of lower transaction fees and quicker processing times. However, please be aware of the volatile nature of cryptocurrencies when using this option.

Other Methods (pending approval)

If our checkout is offline or there are valid reasons why you cannot access the above methods for payment, in certain circumstances, we are able to offer the following:- Stripe: This is a widely-used payment processing solution that allows you to make payments using various credit and debit cards. Stripe is known for its robust security measures, ensuring that your financial information is well-protected.

- PayPal: A popular online payment system that allows you to pay for services without sharing your financial information with the merchant. You can link your bank account, debit card, or credit card to your PayPal account. It’s a quick and secure way to make payments online.

- Bank Transfer (in USD): If you prefer traditional methods, you can also pay via bank transfer. Please note that this method may take a few business days to process and may incur additional fees from your bank. Make sure to transfer the exact amount in USD to avoid any discrepancies.

By offering these diverse payment options, we aim to cater to the varied preferences of our clients, making the payment process as seamless as possible.

- How Do I Get Paid for Trading with UltraCap? What is the Payout Process?

At UltraCap Trading, our Live Portfolio Managers (LPMs) are compensated through a bi-monthly Payout Process. Once you’ve met the performance criteria outlined in your contract, you can submit an invoice for services rendered. This triggers our internal process, where we assess the surplus profits and prepare for their redistribution within our larger operational framework and funding partner technology products. Our finance team then processes the Payout Request via payment to the LPM nominated account/method.

Profits and losses in the live account are part of a wider pool of funding provided in a master account. Payouts to traders are fees paid to the traders aligned to the valid performance return of individual live accounts (profit split) and are validated at the time of meeting the requirements to request payout. Until the requirements are met, and a payout request/event is reached, any or all losses and profits in live accounts belong to the master margin account and pool.

What Payout Methods does UltraCap Trading provide?

At UltraCap Trading, we understand that flexibility is key when it comes to receiving your payout fees. That's why we offer a diverse range of payout methods to suit your individual needs and preferences. Our payout options include:

- Bank Wire Transfer: A secure and straightforward way to receive your invoiced payout fees directly into your bank account in a range of countries.

- EFT (Electronic Funds Transfer): An efficient and convenient method to have your payout fees transferred directly to your bank account.

- Cryptocurrency: For the tech-savvy traders among us, we provide the option to receive your payout fee in Bitcoin or USDC.

- Do I need to pay taxes on my income from UltraCap Trading?

Yes, any income you earn from trading with UltraCap is subject to taxation based on your country of residence. We recommend consulting with a tax advisor to understand your tax obligations better.

6. Support and Resources

- How Can I Contact UltraCap Trading for Support?

You can reach out to us through various channels for support, including email, live chat, and within our client portal. Our support team is available during business hours to assist you with any queries or issues you may have.

- What Exclusive Benefits and Services Does UltraCap Trading Offer?

While we don’t offer training or educational resources, we do provide exclusive benefits and services to our traders. These include software discounts, trade copying software, and other resources that will soon be available through our client portal.

- What Is UltraCap Trading's Support Structure?

We have a multi-tiered support structure to cater to different needs:

- Customer Support Team: Handles public inquiries and general questions.

- Partner and Affiliate Team: Manages partnerships, affiliates, and general PR/associate inquiries. We are open to bespoke arrangements and love to work with communities to offer as much opportunity to good traders as possible.

- Dedicated Accreditation and LPM Support: Provides specialized support for those in our Accreditation Program and Live Portfolio Managers (LPMs). This team has direct access to dedicated resources and technical teams for the platforms provided.

- Risk Management Team: Handles onboarding, communicates with accreditation traders on account management, and liaises directly with the technology and accounts departments for funding partner analysis. They also work closely with LPMs to ensure consistency and viability in trading strategies.

- Are There Opportunities for Sales Traders at UltraCap Trading?

Yes, we are actively seeking sales traders to help expand our footprint and work more closely with retail traders. Sales traders function like account managers for a community or a recruited group of traders. They are not only compensated for their mentoring and management but are also provided with accreditation access and macro pool access to develop their own trading strategy edge.

- What Is the Response Time for Support Queries at UltraCap Trading?

Our support team aims to respond to all queries within 24 hours during Australian business hours. While our teams work varied hours in this post-COVID era of remote working, you can expect responses to customer queries to align with Australian Business Hours Timeframes. For more urgent matters, we recommend using our live chat feature for escalated assistance or reaching out within a community we are working within for more tailored support.

7. Live Trading and Career Options

- What Payout Methods does UltraCap provide?

At UltraCap Trading, we understand that flexibility is key when it comes to receiving your Payout Fees.

Our payout options include:

- Bank Wire Transfer: A secure and straightforward way to receive your invoiced payout fees directly into your bank account in a range of countries.

- Cryptocurrency: For the tech-savvy traders among us, we provide the option to receive your payout fee.

- What Capital Will I Be Trading With at UltraCap Trading?

The capital you’ll be trading with depends on the specific Accreditation Plan you’ve chosen and successfully completed. The amount of capital allocated to you is outlined in your LPM contract and is designed to align with your demonstrated skills, risk management capabilities, and trading strategy.

- What Is the Profit Share for Live Trading at UltraCap Trading?

The profit share for live trading is stipulated in your LPM contract and is based on a fee-for-service model. This means you’ll be compensated for the trading services you provide to UltraCap, in alignment with the profit share agreement outlined in your contract. Depending on choice, you will be eligible to invoice us an amount that is up to 90% the profits generated on the live funded account.

- Can I Have Multiple Live Trading Accounts at UltraCap Trading?

Yes, you can have up to 3 accounts of each Plan Type, but this is subject to certain conditions and approvals, and you cannot trade copy between them. They must be distinctly different trading approaches. Stacking accounts, trade copying between accounts is not permitted. Having multiple accounts allows you to diversify your trading strategies and risk, but it also requires you to manage multiple accounts effectively.

- What Happens After I Pass the Accreditation Program at UltraCap Trading?

Once you successfully pass the Accreditation Program, you enter the onboarding phase. This involves receiving a formal letter of offer, undergoing the Know Your Customer (KYC) process, and signing your Live Portfolio Manager (LPM) contract. After these steps are completed, you’ll be onboarded into our unique trading ecosystem with a live funded account.

- What Career Growth and Progression Options Does UltraCap Trading Offer?

UltraCap Trading is committed to the career growth of its traders. As you gain experience and demonstrate consistent trading results, there are opportunities for live funding allocations and profit share fee percentages will increase. We also offer roles such as Sales Traders, who function like account managers for communities or groups of traders. These roles not only provide additional income streams but also offer a pathway for further career development within the company.